At the end of the year, what is the trend of base oil at the end of the year?

January 06, 2024

At the end of the year, what is the trend of Base Oil at the end of the year?

Main body Global lubricant base oil market demand analysis At present, the global lubricant base oil market demand is in a stable growth state. With the continuous advancement of the industrialization process, the demand for lubricants in the automobile manufacturing industry, aerospace industry, machinery manufacturing industry and other industries continues to increase, prompting the global lubricant market to continue to expand.

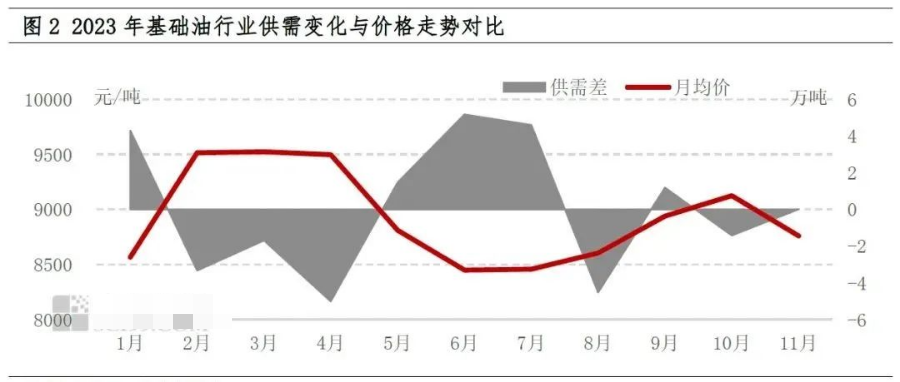

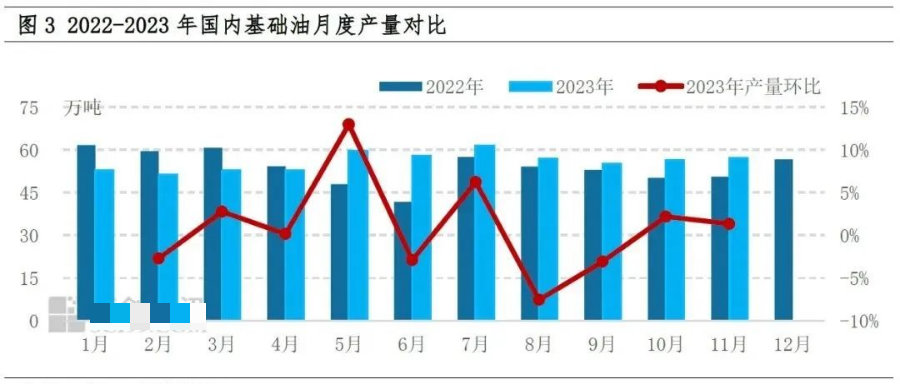

At the same time, the increase in environmental awareness has also had an impact on the global lubricant market. More and more countries and regions have begun to implement environmental protection policies, and the quality requirements for lubricating oil are getting higher and higher. This trend has also led to more research and development investment and innovation, driving the global lubricant market to a higher quality, greener and more sustainable direction. The supply of domestic base oil The average annual growth rate of base oil production capacity from 2019 to 2023 is 6.31%. Domestic installation capacity is becoming increasingly concentrated, and import dependence has dropped from 49.3% to 29.2%, showing a cliff-like decline. In the rapid capacity expansion cycle from 2019 to 2022, the new capacity will mainly be more than 400,000 tons of large-capacity installations. Domestic base oil products are developing in the direction of self-sufficiency, and the next step is expected to develop in the direction of high-end resources. From the perspective of regional distribution of new production capacity, the regional production capacity of base oil has changed little, and has been concentrated in East China and South China, and the new capacity expansion is mainly concentrated in this region. The type of basic oil enterprises has been developed from three barrels of oil to private dominated, and market-oriented development is also related to the increasing maturity of domestic technology. Domestic base oil market trend In November 2023, the domestic base oil market fluctuated downward. Data show that as of November 30, the average price of domestic base oil 150N market was 8595 yuan/ton, down 4.85% month-on-month and 19.67% year-on-year. In comparison, domestic base oil prices in November 2023 were still at a near five-year high, and the average price of base oil in 150N months was 8753 yuan/ton, down 3.84% month-on-month and 13.03% year-on-year.

The change of base oil price is affected by many factors such as supply and demand, cost and profit, crude oil and policy. Domestic base oil prices fell in November mainly affected by supply and demand; At the same time, the stable decline in raw material prices has also affected the price of base oil to a certain extent. Weak demand transmission, base oil prices under pressure In November, base oil entered the off-season demand, just need to reduce. During the month, crude oil fluctuated frequently, the overall downward trend, and the news surface was short; Operators are not optimistic about the future price of base oil, downstream and dealers just need to replenish inventories, and market turnover has declined. According to comprehensive estimates, domestic base oil demand in November is expected to be 704,900 tons, a decrease of 1.66% from the previous month and a decrease of 6.89% from the same period last year. The market is expected to decline, demand is slightly reduced, and base oil prices are under pressure. Limited supply growth, appropriately curb the decline On the supply side, the newly started manufacturers in the month, and the domestic base oil production increased slightly from the previous month. According to the data, in mid-November, the maintenance equipment of Henan Junheng and Nanjing Refinery was restored, involving a production capacity of 550,000 tons/year; Near the end of the month, Shandong Jincheng maintenance equipment was restored, involving a production capacity of 600,000 tons/year. Affected by this, the total domestic base oil production in November was about 570,000 tons, an increase of 1.3%; The average industry start level was 42.5%, up 0.5 percentage points from October. In terms of imports, the landed cost of base oil decreased, the tight price of imported resource goods increased, the theoretical profit of imports increased, and the import is expected to increase in November. On the one hand, the decline in the price of base oil in November, coupled with the rise of the RMB exchange rate, reduced the cost of imports; On the other hand, the import volume of base oil in the previous period declined significantly, resulting in tight domestic supply and rising prices. In this way, the theoretical profit of domestic imported base oil increased, as of the end of November, the average theoretical profit of domestic imported second class base oil was 524 yuan/ton. The increase of import profit drives the increase of import demand; However, the amount of Formosa refinery equipment maintenance reduced, while domestic demand weakened, the price is expected to decline, import trading is more cautious, import growth or relatively limited, November base oil imports are expected to be in the range of 100,000 to 130,000 tons. Domestic resource supply increased slightly, import volume is expected to increase, the total domestic base oil supply in November is expected to be 705,000 tons, an increase of 0.3%, the supply growth is not obvious, to a certain extent, inhibit the speed and amplitude of the price decline. The price of raw materials fell, and the bottom support of prices fell Base oil belongs to the near-oil end products, and its raw material cost is affected by the fluctuations of international crude oil prices. The overall downward trend of crude oil in November, during which there was an occasional rebound, but the range was limited, and the price of base oil raw materials fell accordingly. In November, the average price of domestic second-line oil was 6,627 yuan/ton, down 0.08% from October. The average price of hydrogenation tail oil was 6215 yuan/ton, down 6.12% from the previous quarter. According to statistics, as of November 30, the theoretical profit of domestic base oil based on line reduction oil was 125.9 yuan/ton, an increase of 50 yuan/ton from the beginning of the month; The theoretical profit of base oil with hydrogenation tail oil as raw material was 473 yuan/ton, an increase of 100 yuan/ton from the beginning of the month. Raw material prices fell, the profit margin of base oil expanded, and the bottom support of the raw material end to the price weakened. Future market outlook In December, the domestic base oil market was still mainly affected by supply and demand. In December, the new base oil manufacturers were more concentrated, involving a production capacity of about 750,000 tons/year, and the output in the month may increase to 640,700 tons, up 12.45% from the previous month; As demand enters the off-season, it is expected to continue to shrink slightly, so the gap between supply and demand is widening, and the downward pressure on base oil prices is increasing. However, international crude oil prices are expected to stabilize at a low level in December, and a moderate rebound to repair the previous decline, and the raw material side moderately supports base oil prices. Overall, it is expected that the domestic base oil market will continue to decline in December.